Amazon Cloud Competitor Blackblaze Files to Go Public

The world continues to move to the cloud and one company that rivals Amazon’s cloud storage is making its debut on the market.

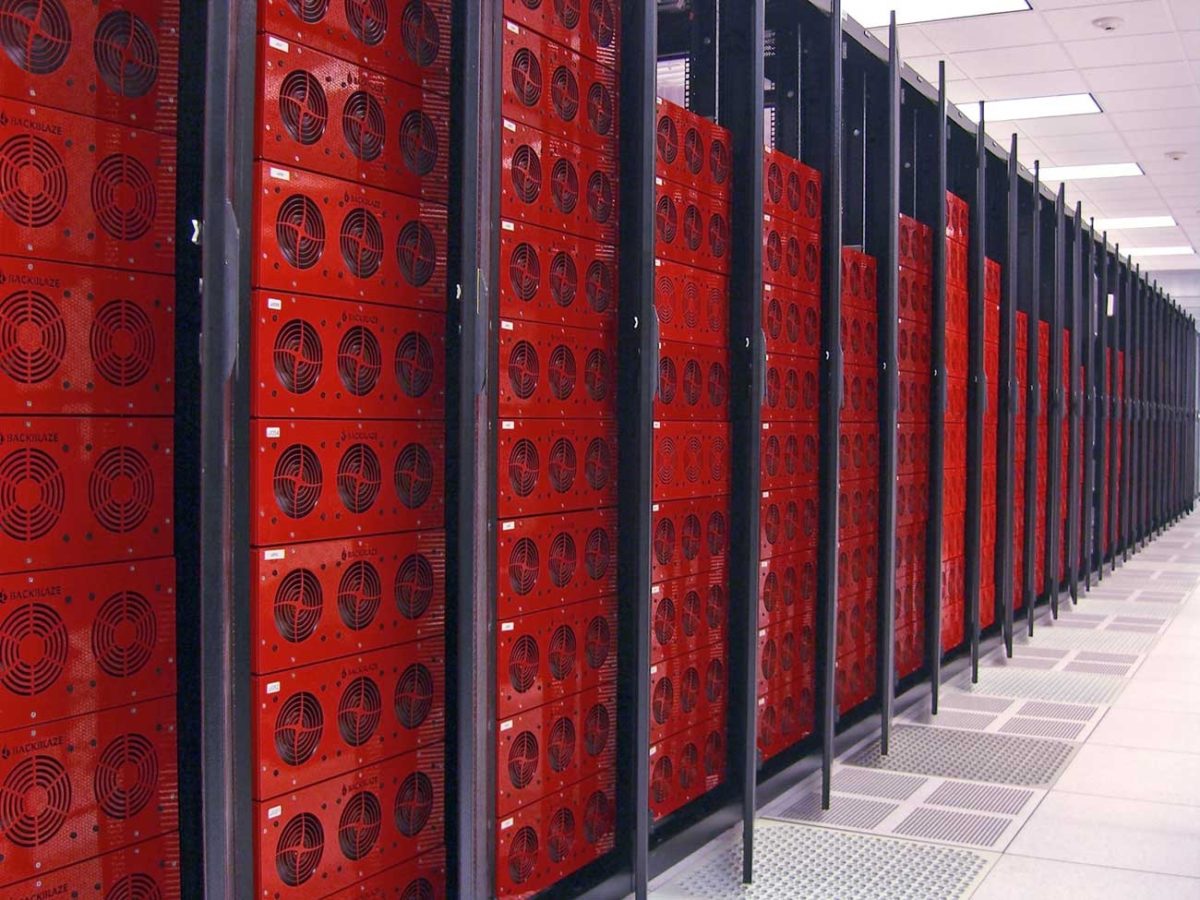

Backblaze, a company that backs up data on people’s computers and provides cloud-based storage space that companies use to store and retrieve files, filed to go public on the Nasdaq on Monday. Shares will trade under the symbol “BLZE.”

Backblaze’s B2 object-storage service competes with offerings from Amazon and other cloud providers. B2 represents less than one-third of total revenue, but it is growing 60% year over year.

“The market is demanding alternatives to the traditional, diversified public cloud vendors for multiple reasons,” Backblaze said in its IPO prospectus. “These public cloud vendors have increasingly focused on the largest enterprises, resulting in significant complexity in their products and pricing that leaves behind mid-market businesses”

The company was established in 2007 and the next year released online backup services for PCs running Apple’s MacOS and Microsoft Windows.

The Backblaze website says data storage from the B2 service costs 76% less than Amazon’s AWS’ S3 storage service, with 80% less expensive data download fees.

Amazon S3 enjoys a gross margin percentage in the low 50s, says one analyst’s estimate, while Backblaze, with its lower object-storage pricing, has an overall gross margin of 50%.

Backblaze reported a $2.4 million loss on $16.2 million in revenue in the second quarter. While revenue grew 24% from the year-ago quarter, the loss widened from $1.9 million.

Oppenheimer and Co., William Blair and Raymond James are the lead underwriters of the initial public offering.

Disclaimer: We have no position in any of the companies mentioned and have not been compensated for this article.