Sponsored – Est. 9 Min Read

HIGH UPSIDE ALERT:

Invest in North America’s Next Great Gold-Copper Asset for Potentially Pennies on the Dollar

Troilus Gold Corp. (TSX: TLG); (OTCQX: CHXMF) is advancing one of North America’s largest undeveloped gold-copper deposits towards production

Analysts’ consensus price target for the company’s shares represents potential upside of 118% from the current price

7 REASONS

Why Troilus Gold Corp. (TSX: TLG); (OTCQX: CHXMF) Should Be On Your Radar Today

1

A Generational Scale Asset: Troilus Gold Corp. (TSX: TLG); (OTCQX: CHXMF) has one of the largest undeveloped gold-copper deposits in North America. Over the past several years, Troilus Gold Corp. has grown the resource from what was a two-million-ounce, underground opportunity to a 13 million-ounce measured, indicated & inferred resource.

2

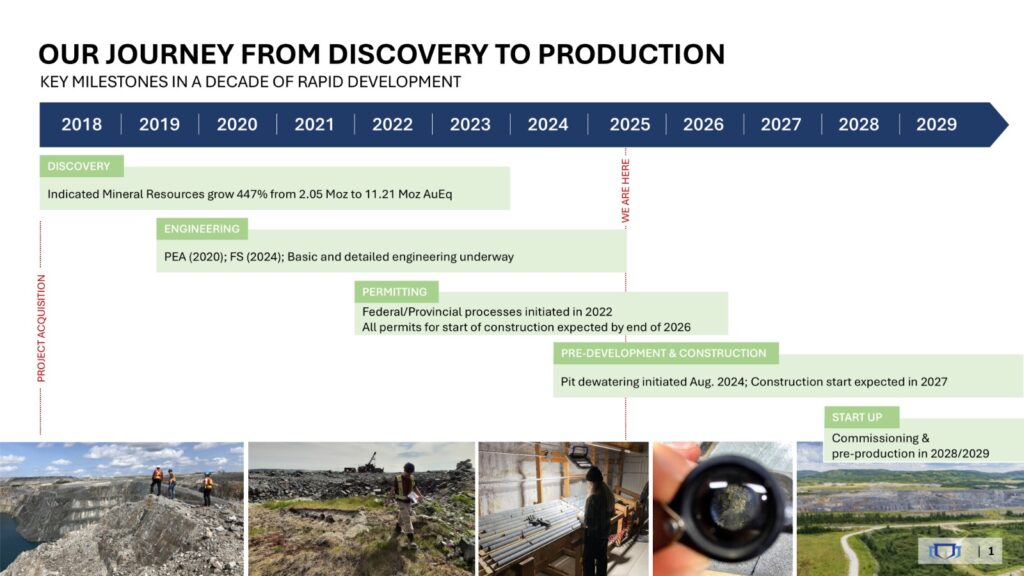

Advancing Toward Production: In May 2024, a feasibility study was completed that was the culmination of five years of work and 350,000 meters of drilling. The study showed a projected 22-year mine life…average annual production of 303,000 ounces of gold equivalent…and peak annual production of 536,400 ounces of gold equivalent. Pit dewatering at the property began in August 2024 and all permits for start of construction at the project are expected by end of 2026.

3

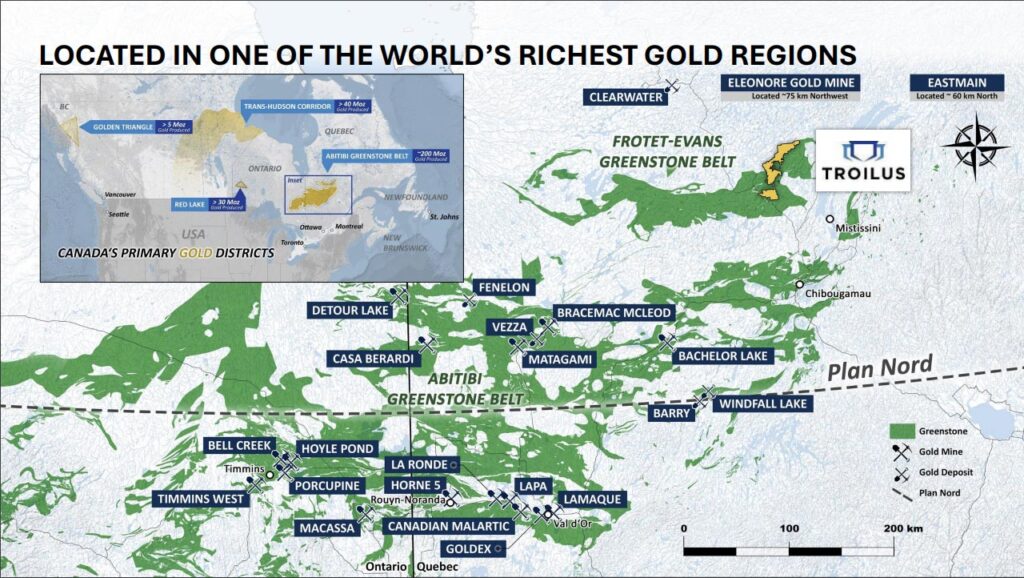

Located in a Gold-Rich, Tier-1 Mining Jurisdiction: The project is located in a mining-friendly, gold-rich region. Quebec was ranked among the top five mining jurisdictions in the world by the Fraser Institute in 2023.

4

Long-Term Bull Market for Gold: Gold prices have soared by more than 46% over the past year and experts are calling for a continued red-hot bull market for gold. UBS recently raised its gold price target to $3,500/oz. by the end of 2025[i] and proclaimed that “the case for gold has become more compelling than ever in this environment of escalating tariff uncertainty, weaker growth, higher inflation and lingering geopolitical risks.”[vii]

5

Low All-In Sustaining Costs: All-in sustaining costs for production were estimated at a low $1,109 per ounce, which is very favorable when compared to the most recent quarterly AISCs reported by Newmont and Barrick of $1,611/oz. and $1,498/oz. respectively.

6

Undervalued Opportunity: As the company has worked to fund this large gold-copper project in Quebec, fears of excessive equity dilution have placed downward pressure on the share price. This creates an opportunity for investors to add shares of Troilus Gold at what appears to be a deep discount, as positive news on funding could have a significant impact on the share price.

7

*Analyst Consensus 118% Potential Upside: Currently five analysts have “buy” or “outperform” ratings on Troilus Gold Corp. (TSX: TLG); (OTCQX: CHXMF). And the consensus price target for the company’s shares is $1.55. That represents an upside of 118% from the share price as of this writing.

Size, Location and Timing:

Troilus Gold Corp. is Developing a Generational-Scale Asset – in a Gold-Rich Region – as Gold Prices Continue to Climb

In the midst of a potentially historic long-term bull market for gold, one Canadian company now appears to present a high-upside scenario for early investors.

It’s a company still flying below the radar of most investors in spite of the enormous potential of its gold-copper asset. But that may not be the case for long. Here’s what is now unfolding:

With gold prices climbing steadily for the past two years – to the current price of around $3,300/oz. – mining stocks are now in an extremely favorable environment.

Experts are broadly confident that this gold bull market will have legs, with several major institutions recently raising their targets. UBS forecasts gold at $3,500 by the end of 2025 and Goldman Sachs is even more bullish, forecasting $3,700 by late 2025 and up to $4,000 by mid-2026.[iii][viii][ix]

“The case for gold has become more compelling than ever.”

![]()

In the midst of this long-term bull market for gold, one company has emerged as an intriguing, undervalued resource play offering significant upside in the months ahead.

That company is Troilus Gold Corp.

Troilus Gold Corp. (TSX: TLG); (OTCQX: CHXMF) is right now advancing one of North America’s largest undeveloped gold-copper deposits towards production.

Breaking News

Troilus Mandates Syndicate of Global Lenders for Up to US$700 Million Project Financing

On March 13, 2025 Troilus Gold Corp. (TSX: TLG); (OTCQX: CHXMF) announced that it has executed a non-binding mandated term sheet with a syndicate of leading global financial institutions, including Societe Generale, KfW IPEX-Bank, and Export Development Canada (“EDC”), (together the mandated lead arrangers or “MLAs”) to arrange a structured project debt financing package of up to US$700 million for the development and construction of the Troilus Gold-Copper Project.

This syndicate of lenders brings deep expertise in structuring project financing for large scale mining developments, reinforcing Troilus as a globally recognized, financeable asset. The execution of this term sheet represents a major milestone in advancing towards a fully funded construction package and follows four previously announced Letters of Intent (“LOIs”) from global export credit agencies (“ECAs”) totaling up to US$1.3 billion.

Troilus Gold Appears Poised to Emerge as One of Canada’s Largest Future Gold-Copper Producers

The first thing to know about the opportunity with Troilus Gold Corp. is that the company is dealing with an extremely large gold-copper asset.

The company’s Troilus Project is on the site of the former Troilus gold and copper mine, a past-producing mine located in the tier-one mining jurisdiction of Quebec, Canada.

Quebec was ranked among the top five mining jurisdictions in the world by the Fraser Institute in 2023.

The project’s existing infrastructure provides Troilus Gold Corp. with a huge advantage, as there is power running directly to the mine site and truck-ready roads leading to the project.

Troilus Gold currently holds a large land position of 435 km2 within the Frotet-Evans Greenstone Belt, one of the world’s richest gold regions.

The former Troilus gold and copper mine, located in the prolific Val-d’Or district of Quebec, was operated from 1996 to 2010 by Inmet Mining Corp. During that time, the mine produced 2 million ounces of gold and 70,000 tonnes of copper via two open pits.

The mine was shut down in 2010 as the company focused its attention on its South American copper assets.

The mine was then acquired in 2016 privately from First Quantum Minerals, who had acquired Inmet, and in the years since Troilus Gold Corp. has invested $100 million into the ground.

During that time, Troilus Gold Corp. has grown the resource from what was a two-million-ounce, underground opportunity into a 13 million-ounce – and growing – opportunity moving towards development…

…and potentially one of North America’s largest undeveloped gold-copper deposits that is set to emerge as one of Canada’s largest future producers.

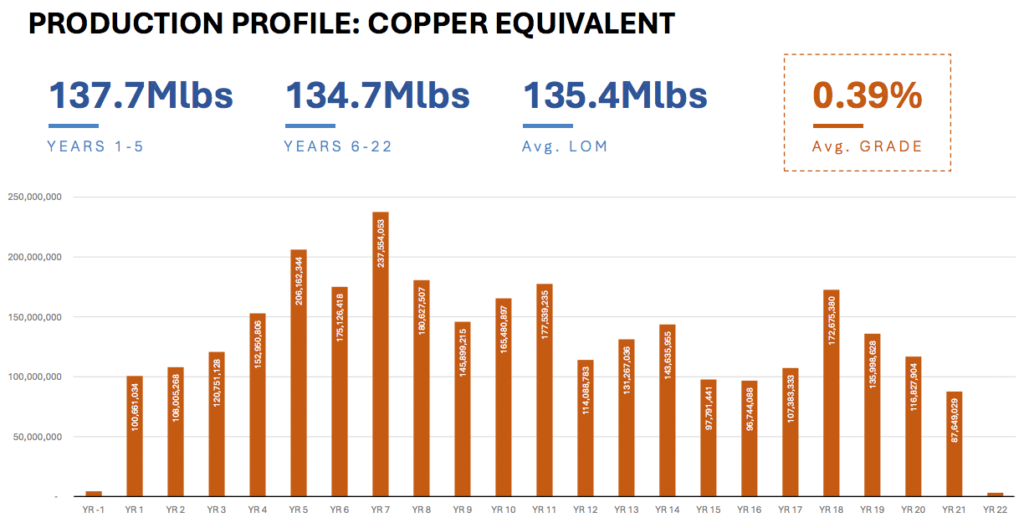

Feasibility Study Shows 22-Year Mine Life and 536,400-oz Peak Annual Production

A feasibility study completed in May 2024 shows the potential for Troilus Gold to rank among the largest gold producers in Canada with life-of-mine average annual production of 303,000 ounces of gold equivalent (80% gold, 20% copper) over a 22-year mine life.

And peak annual production is projected to reach a high of 536,400 ounces of gold equivalent annually.

That type of annual production places the Troilus Project right alongside the top producers in all of Canada.

In addition, all-in sustaining costs (AISC) for production were estimated at a low $1,109 per ounce, which is very favorable when compared to the most recent quarterly AISCs reported by Newmont and Barrick of $1,611/oz. and $1,498/oz. respectively.

At the current gold price of over $3,300/oz., Troilus will generate over $340 million in free cash flow annually.

Troilus Gold Corp. is Moving Quickly On its Journey from Discovery to Production

Troilus Gold Corp. (TSX: TLG); (OTCQX: CHXMF) has accomplished a tremendous amount in a short period of time.

As a result of previous operation at the Troilus Project, the company inherited a well-established infrastructure valued at approximately $500 million.

This infrastructure includes an extensive network of well-maintained all-weather access roads, a 50MW substation and over 60 kms of high-tension power lines.

This significant inherited infrastructure helps keeps capital intensity low for the project.

Troilus Gold Corp. was formed around the Troilus Mine in 2018 and in the years since its formation the company has taken full advantage of its inherited infrastructure and developed quickly.

To date, the company has drilled more than 325,000 meters and it has grown its indicated mineral resources by 447% to 11.21 million ounces of gold equivalent.

Several prospective regional targets have also been identified, providing long-term growth upside to strengthen Troilus’s position as a leading gold-copper project in Quebec.

Why Shares of Troilus Gold Corp. (TSX: TLG); (OTCQX: CHXMF) Could Be Severely Undervalued

One of the things that makes the opportunity with Troilus Gold Corp. (TSX: TLG); (OTCQX: CHXMF) especially attractive for investors is the opportunity to buy while the company’s shares appear significantly undervalued.

Fears of excessive equity dilution to fund the Troilus Project at its projected $1.08 billion initial capex, downward pressure has kept the share price below expectations.

This triggered a window of opportunity for those investors who see the true potential for the company as it moves forward in advancing one of North America’s largest undeveloped gold-copper deposits towards production.

But that window of opportunity could quickly close in the days and weeks ahead as the company moves forward with further de-risking and progressing in its mining life cycle.

Troilus Gold Continues to Expand and De-Risk Its Project

On March 13, 2025 the company announced that it has successfully converted US$1.3 billion in LOIs that were announced in November 2024 into a fully mandated commitment of up to US$700 million in structured project financing.

This amounts to the largest mining investment in Quebec and one of the largest Canadian mine debt financings in recent history.

The package is being led by Société Générale (Paris), KFW IPEX-Bank (Germany), and Export Development Canada (EDC), who will direct-lend to Troilus based on ECA guarantees.

This financing marks a huge step forward in de-risking the project and moving towards development. Financing is one of the biggest hurdles for projects of this scale, and this commitment is a strong endorsement of Troilus’ fundamentals.

Additionally, Troilus Gold is expected to continue looking to expand the economics of the project with additional drilling.

In fact, in September 2024 the company announced positive drill results from an 1,866-meter exploratory drill program on its West Rim target of the property.

This target was located within 150 meters of the North Reserve Pit Shell at its Troilus Project and the program identified gold targets that were 40% higher grade than at the main site.

This could help not only expand but expedite the project as the company continues to explore the potential for tapping into higher-grade gold deposits early in the development process.

Troilus Gold Corp.’s Copper Resources Offer Additional Upside Potential

It’s important to understand that the copper component of the Troilus Gold story is also significant.

The copper market, much like gold, is in the midst of an impressive bull run with no signs of slowing down thanks to soaring demand for copper worldwide.

“Copper’s bull run should continue for at least the next three years, fueled by global supply challenges and hot demand for the metal to power energy transition and artificial intelligence technologies, industry analysts say.”

Copper makes up only about 15% of Troilus Gold’s deposit, but is an important element and provides tremendous leverage to the company because of copper’s “critical mineral” status and its role in global electrification efforts.

The company’s location in Quebec is also an important consideration when it comes to its copper resource, as Quebec is at the forefront of incentivizing and building battery material supply chains to help support plans for the clean energy transition.

The Troilus Project is currently the largest permitting-stage copper project in Quebec and the third-largest undeveloped copper deposit.

This positions the company as a strong candidate for advancing towards production of this critical asset in Quebec, especially as the provincial government places increasing emphasis on copper resource development.

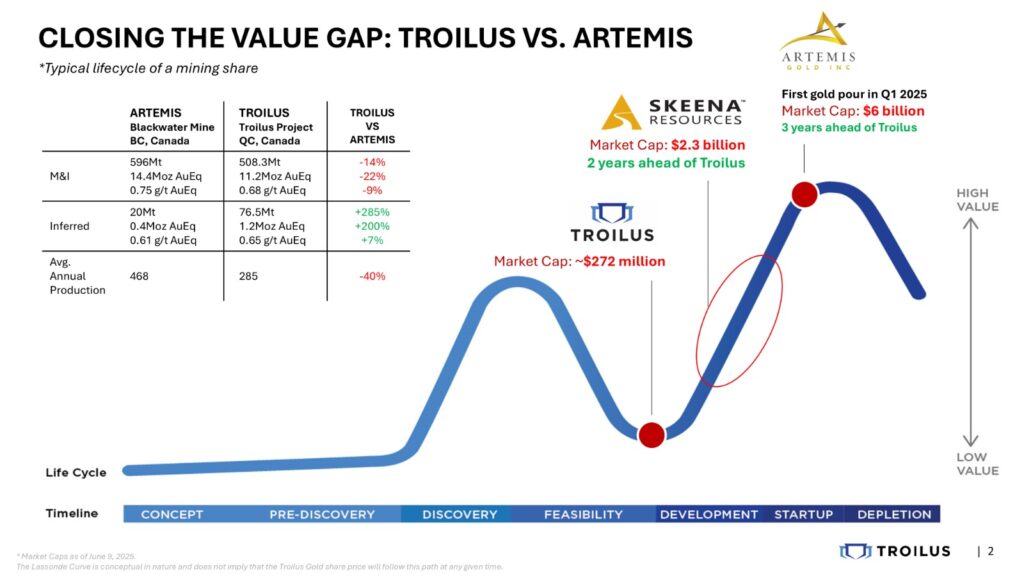

Following the Path of a C$6 Billion Market Cap Gold Company: Is Troilus Gold Corp. the Next Artemis Gold?

When it comes to understanding the life cycle growth of any exploration company, it’s important to remember that there are stages within a company’s life cycle that can offer the potential for significant value creation.

The Lassonde Curve is a graphical representation that illustrates the various stages of value creation in a mining company’s life cycle.

As you can see from the graph above, there is a distinct “lull” just after the feasibility stage before the development stage triggers potentially explosive growth.

With its feasibility study completed earlier this year, this “lull” is the stage where Troilus Gold Corp. (TSX: TLG); (OTCQX: CHXMF) now appears to be.

Just how lucrative could this opportunity be as the company progresses up the curve?

Take as an example Artemis Gold (TSXV: ARTG).

Despite Troilus Gold’s smaller resource and production profile, the company is very similar to Artemis Gold – with a similarly-sized resource – and potentially on the same path for growth.

This is a path which took Artemis to a market cap of over C$6 billion as it progressed along this very same life cycle path, as you can see in the image below.

Artemis Gold had its first gold pour in Q1 2025.

So the progression through the next stage of the Lassonde Curve for Troilus Gold has the potential to be very exciting when viewed in comparison to Artemis Gold.

Even if you consider the potential for Troilus Gold to reach 50% of Artemis Gold’s current market cap, that $3 billion would represent an 11x gain from today’s valuation.

And as Troilus Gold Corp. continues to advance its project, it is also possible that the company attracts the attention of mid-tiers and major gold companies looking to grow.

A project the size of the Troilus Project is truly rare – especially in Canada – so the potential exists for things to move quickly on the M&A front at any time.

Analysts’ Consensus:

*118% Potential Upside for Troilus Gold Corp.

While Troilus Gold Corp. continues to fly beneath the radar of most individual investors, there are many larger investors and analysts who are very much aware of the company’s significant potential upside.

Troilus Gold is currently 65% institutionally held and has enjoyed long-term support from very large institutions.

And currently five analysts have “buy” or “outperform” ratings on Troilus Gold Corp. (TSX: TLG); (OTCQX: CHXMF).

The consensus analysts’ price target for the company’s shares is $1.55…that represents an upside of 118% from the share price as of this writing.

- Cormark analyst Richard Gray says that Troilus Gold Corp. is “trading at a significant discount to other large development projects…we believe Troilus is a potential takeout target for midtier and senior producers looking for growth in a Tier 1 jurisdiction.”

- Redcloud analyst Timothy Lee says, “The numbers are similar to those of other major gold projects in Canada that have since been acquired by major producers…we believe Troilus is a desirable target for a senior producer.”

- Haywood analyst Pierre Vaillancourt writes that Troilus Gold Corp. “is a significant scale-up from the PEA and will benefit from strong leverage in this gold environment…we believe TLG has added value to the project.”

- And Desjardins analyst Allison Carson writes, “We view Troilus as a potential acquisition target and see significant upside to its current valuation based on recent comparable takeout multiples.”

7 REASONS

Why Troilus Gold Corp. (TSX: TLG); (OTCQX: CHXMF) Should Be On Your Radar Today

1

A Generational Scale Asset: Troilus Gold Corp. (TSX: TLG); (OTCQX: CHXMF) has one of the largest undeveloped gold-copper deposits in North America. Over the past several years, Troilus Gold Corp. has grown the resource from what was a two-million-ounce, underground opportunity to a 13 million-ounce measured, indicated & inferred resource.

2

Advancing Toward Production: In May 2024, a feasibility study was completed that was the culmination of five years of work and 350,000 meters of drilling. The study showed a projected 22-year mine life…average annual production of 303,000 ounces of gold equivalent…and peak annual production of 536,400 ounces of gold equivalent. Pit dewatering at the property began in August 2024 and all permits for start of construction at the project are expected by end of 2026.

3

Located in a Gold-Rich, Tier-1 Mining Jurisdiction: The project is located in a mining-friendly, gold-rich region. Quebec was ranked among the top five mining jurisdictions in the world by the Fraser Institute in 2023.

4

Long-Term Bull Market for Gold: Gold prices have soared by more than 46% over the past year and experts are calling for a continued red-hot bull market for gold. UBS recently raised its gold price target to $3,500/oz. by the end of 2025[i] and proclaimed that “the case for gold has become more compelling than ever in this environment of escalating tariff uncertainty, weaker growth, higher inflation and lingering geopolitical risks.”[vii]

5

Low All-In Sustaining Costs: All-in sustaining costs for production were estimated at a low $1,109 per ounce, which is very favorable when compared to the most recent quarterly AISCs reported by Newmont and Barrick of $1,611/oz. and $1,498/oz. respectively.

6

Undervalued Opportunity: As the company has worked to fund this large gold-copper project in Quebec, fears of excessive equity dilution have placed downward pressure on the share price. This creates an opportunity for investors to add shares of Troilus Gold at what appears to be a deep discount, as positive news on funding could have a significant impact on the share price.

7

*Analyst Consensus 118% Potential Upside: Currently five analysts have “buy” or “outperform” ratings on Troilus Gold Corp. (TSX: TLG); (OTCQX: CHXMF). And the consensus price target for the company’s shares is $1.55. That represents an upside of 118% from the share price as of this writing.

Sources

*as of May 2025

[i] https://www.barrons.com/articles/gold-rally-rates-tariffs-hedge-70b2ebe6

[ii] https://www.barrons.com/articles/gold-rally-rates-tariffs-hedge-70b2ebe6

[iii] https://www.sbcgold.com/blog/experts-boost-gold-price-forecasts-for-2024-2025-again/

[iv] https://www.reuters.com/business/finance/most-banks-expect-golds-bull-run-persist-into-2025-2024-09-24/

[v] https://www.reuters.com/markets/commodities/bulls-jump-deeper-into-copper-amid-supply-

challenges-ai-fueled-demand-2024-04-12/#:~:text=%22Copper’s%20second%20secular%

20bull%20market,next%20two%20to%20three%20years.%22

[vi] https://www.barrons.com/articles/gold-rally-rates-tariffs-hedge-70b2ebe6

[vii] https://www.barrons.com/articles/gold-rally-rates-tariffs-hedge-70b2ebe6

[viii] https://www.investing.com/news/commodities-news/ubs-forecasts-3500-gold-price-in-2025-rally-to-extend-into-2026-3980795

[ix] https://finance.yahoo.com/news/goldman-sachs-analyst-predicts-4-150951387.html

[x] https://www.investing.com/news/commodities-news/ubs-forecasts-3500-gold-price-in-2025-rally-to-extend-into-2026-3980795

Full Disclaimer:

This website/newsletter is owned, operated and edited by Jade Cabbage Media LLC. Any wording found in this e-mail or disclaimer referencing “I” or “we” or “our” or “Jade Cabbage” refers to Jade Cabbage Media LLC. This webpage/newsletter is a paid advertisement, not a recommendation nor an offer to buy or sell securities. Our business model is to be financially compensated to market and raise awareness for small public companies.

By reading our newsletter and our website you agree to the terms of our disclaimer, which are subject to change at any time. We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature and are therefore unqualified to give investment recommendations. Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. Companies with low price per share are speculative and carry a high degree of risk, so only invest what you can afford to lose. By using our service you agree not to hold our site, its editor’s, owners, or staff liable for any damages, financial or otherwise, that may occur due to any action you may take based on the information contained within our newsletters or on our website.

We do not advise any reader to take any specific action. Losses can be larger than expected if the company experiences any problems with liquidity or wide spreads. Our website and newsletter are for entertainment purposes only. Never invest purely based on our alerts. Gains mentioned in our newsletter and on our website may be based on end-of-day or intraday data. This publication and their owners and affiliates may hold positions in the securities mentioned in our alerts, which we may sell at any time without notice to our subscribers, which may have a negative impact on share prices. If we own any shares we will list the information relevant to the stock and number of shares here. The Jade Cabbage Media business model is to receive financial compensation to raise awareness for public companies.

Pursuant to an agreement between Winning Media LLC and the issuer Troilus Gold Corp., Winning Media LLC has been hired for a period beginning on 11/11/24 and ending on 12/11/24 to conduct investor relations advertising and marketing and publicly disseminate information about Troilus Gold Corp. via Website, Email and SMS. Winning Media has been compensated the sum total of one hundred forty thousand dollars via bank wire transfer. Furthermore, Winning Media LLC has paid up to fifteen thousand dollars to Jade Cabbage Media LLC to manage the production budget and digital media campaign for Troilus Gold Corp.

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (TLG). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Jade Cabbage and Winning Media often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.

: