The One Investment to Consider as Gold Prices Begin to Climb

A massive surge in gold prices may already be underway.

With geopolitical concerns on the rise – and higher interest rates forecast for the rest of 2018 and beyond – investors are focusing their attention on gold once again.

Historically speaking, gold moves higher when worries of inflation or geopolitical tension increase.

“Gold Can Regain Its Glitter”

“There’s reason to hope ahead for the metal: Rising tariff tensions and volatility in markets should help boost U.S. demand.”

A potential trade war with China is now triggering worry in the U.S. – and potential nuclear threats from North Korea, Iran and Russia are also contributing to increased equity volatility.

This means that the time is now for investors to consider the possibility of an extreme surge in the price of gold in the weeks and months ahead.

“Gold Is Heading to $1,400 If Trade War Breaks Out”

High-Grade Deposit Provides Significant Re-Rate Upside Potential in 2018 for Bonterra Resources, Inc. (TSX.V: BTR); (OTCQX: BONXF)

As investors prepare for what appears to be an imminent spike in the price of gold, one junior exploration company stands out as offering near-term significant upside potential with multiple corporate catalysts, all coming in 2018.

Timing is critical when investing in an exploration company such as Bonterra Resources.

This company is under the radar now…but recently multiple top tier gold funds, corporates and senior gold investors have done their due diligence and made their investments because of the upcoming corporate catalysts coming in 2018. The opportunity to invest in the early growth stages of Bonterra, alongside these senior level investors, is why the company may not be under the radar for much longer.

This company is Bonterra Resources, Inc. (TSX.V: BTR); (OTCQX: BONXF).

Bonterra Resources Inc. is a Canadian gold exploration company that is focused on the expansion and development of its potential multi-million-ounce, high-grade gold resource at its 100% controlled Gladiator Gold Deposit in the prolific Abitibi Greenstone Gold Belt in Quebec.

Quebec, of course, is one of the most attractive regions in the world for mining and exploration, and is consistently ranked in the Top 5 jurisdictions in the world for mining investment by Fraser Institute.

The Abitibi Greenstone Belt is one the most prolific gold mining areas in the world, having proven up more than 180 million ounces of gold.

The Abitibi Greenstone Belt is one of the largest greenstone belts in the world. These geologic bodies are considered prime hunting grounds for large mineral deposits of metals including gold, silver, copper, and zinc.

Producing companies with interests in the Abitibi Greenstone Belt include…

- Osisko Mining Inc. (TO: OSK) – market cap of $509 million

- Tahoe Resources (NYSE: TAHO) – market cap of $1.47 billion

- Kirkland Lake Gold (NYSE: KL) – market cap of $3.22 billion

- Barrick Gold (NYSE: ABX) – market cap of $14.48 billion.

The Gladiator Gold Deposit: A Potential Multi-Million-Ounce, High Grade Gold Resource

Bonterra’s flagship project is the Gladiator Gold Deposit, located in Quebec’s Chibougamau mining district.

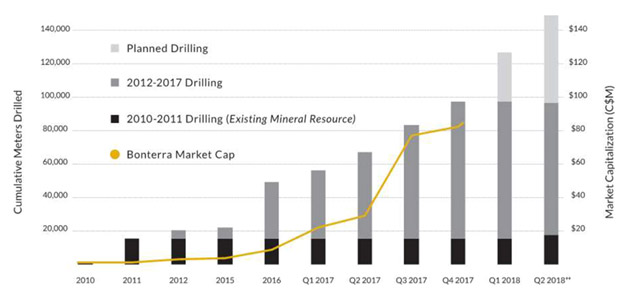

The Company’s initial 2012 resource estimate outlined 273,000 ounces of gold resource at a grade of 9.37 g/t Au. Since that 2012 estimate, however, Bonterra has drilled over 100,000 meters to date that has continued to deliver outstanding high grade drill results. Currently Bonterra is aggressively advancing a 30,000-meter drill program with seven (7) drill rigs, that continues to advance, de-risk, and prepare the Company for its biggest “re-rate” year yet.

In 2012, the deposit measured 250 meters long by 200 meter at depth. So far – as a result of the continued drilling – the deposit has increased by nearly 500%, with continuity of mineralization confirmed over a total drilled strike length on at least four horizons of 1,200 meters…and a drilled depth of 1,000-plus meters.

The Gladiator Gold Deposit remains open in all directions, where at least five distinct sub-parallel zones or mineralized horizons have been identified. Of note, as recent as April 9th, 2018, drilling intersected a 6th mineralized zone!

This drilling program will continue through 2018 – with a target of reaching a total of 150,000 + meters drilled since 2012.

As the potential for the Gladiator Gold Deposit continues to grow – and as the market begins to notice the size of this exceptionally high-grade resource – the potential exists for Bonterra Resources, Inc. (TSX.V: BTR); (OTCQX: BONXF) to see a significant increase in its market capitalization or “re-rate” upwards and beyond its peers.

Bonterra Also Controls a 917,000-ounce Gold Resource in Larder Lake, Ontario

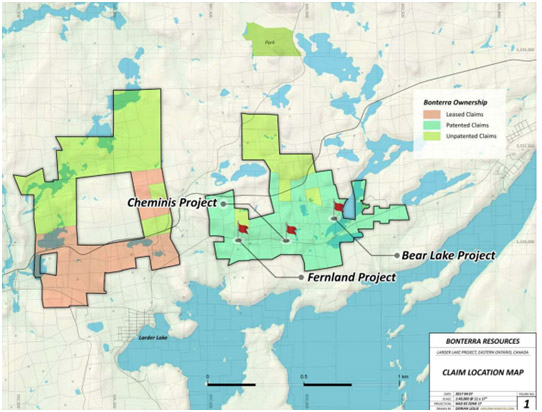

Bonterra’s secondary property is its Larder Lake Gold Project – a 2,165-hectare property located in eastern Ontario, not far from the Quebec border.

The Larder Lake Property hosts the Bear Lake, Cheminis and Fernland gold in a strategic land position along the prolific Cadillac/Larder Break, located 7 kilometers west of the Kerr Addison Mine, which produced 11 million ounces of gold.

This property was purchased by Bonterra in 2016 at a cost of approximately $4 per ounce and has extensive infrastructure and easy access to both highway and power.

A 2011 estimate puts the size of the Larder Lake Project at a potential 917,000 ounces with a grade of 5.5 Au g/t.

Bonterra is currently modelling the Larder Lake Gold project to update the resource to a current 43-101 Compliant Resource.

Comparable Exploration Companies Show the Potential for Bonterra Resources Inc.’s Growth

Here’s what makes Bonterra Resources, Inc. (TSX.V: BTR); (OTCQX: BONXF) such an appealing company for investors to consider now:

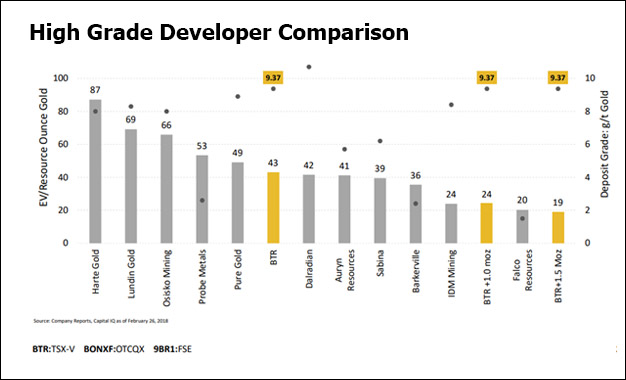

Bonterra Resources Inc. currently has a market cap of approximately $110 million.

But based on the successful high grade drill results delivered to the market since 2015, which looks to yield a much larger gold resource model or resource – and noting the high grade nature of the deposit – the potential exists for Bonterra Resources, Inc. (TSX.V: BTR); (OTCQX: BONXF) to have a significantly higher market capitalization in the near future.

Here’s why:

A number of companies with similar-sized gold properties as Bonterra Resources currently have much higher market caps…even though their deposits may be at a lower grade than Bonterra’s.

- Osisko Mining (TO: OSK)— $509 million market cap –has 10 times the amount of capital than Bonterra Resources Inc. yet has roughly the same amount of resources…and at a lower grade.

- Lundin Gold (TO: LUG) — $1.02 billion market cap – has a comparable resource base to Bonterra’s – at a lower grade – yet has nearly ten times Bonterra’s market cap.

- Sabina Gold & Silver Corp. (TO: SBB) — $387.8 million market cap – has a smaller resource base…at a lower grade than Bonterra – yet has more than triple Bonterra’s market cap.

Some of the World’s Smartest Investors Are Backing Bonterra Resources Inc. (TSX.V: BTR); (OTCQX: BONXF)

As this discrepancy in market cap becomes apparent, investors will begin to take notice and the company’s shares are likely to be re-valued.

In fact, investors have already begun to take notice of this company’s outstanding growth potential.

There are a number of highly-respected investors already backing Bonterra Resources, showing that the company’s plan to build long-term value is a solid one.

This group of investors includes names like Eric Sprott and Rick Rule, as well as ETF issuer Van Eck and Kirkland Lake Gold (TO: KL), who each have substantial positions in Bonterra Resources.

Bonterra Resources Inc. is a well-financed company, with approximately $60 million raised in past 12 months and approximately $40 million in cash on the balance sheet.

Bonterra’s Experienced Management Team Has a History of Delivering Success

One of the most important factors when considering the potential for any exploration company is the quality of its leadership team.

In the case of Bonterra Resources, Inc. the leadership in place has extensive experience in the technical and capital markets…and a proven history of delivering value for shareholders.

Nav Dhaliwal – President, Chief Executive Officer & Director

20 years of leadership and entrepreneurial experience, as well as in corporate and business development. Successful startup and financing expert in numerous active junior resource companies.

Dale Ginn – P. Geo, VP Exploration & Director

Geologist with 30 years of experience in exploration and mining. Led and participated in numerous discoveries and startups. Senior positions with Sprott Mining, Jerritt Canyon, San Gold, Harmony Gold, Hudbay, Westmin, Goldcorp.

Peter A. Ball – VP Operations

Mr. Ball is a mining professional with over 25 years of experience in mining engineering, corporate finance, business development and marketing, and most recently held the position of President & CEO of Redstar Gold Corp.

Joseph Meagher – Chief Financial Officer & Director

Chartered Professional Accountant (CPA, CA) since 2008, and obtained the Chartered Director (C.Dir.) designation from The Directors College in 2017. Mr. Meagher currently serves as the Chief Financial Officer and a Director for several publicly listed companies.

Allan J. Folk – Director

Over 35 years of extensive leadership experience in the Canadian mining finance industry. Currently Vice President of Brant Securities Ltd.

Richard Boulay – B.Sc., Director

Over 40 years of experience in the exploration and mining industries in Canada and internationally, including 15 years of mining and infrastructure financing experience gained with Bank of Montreal, Royal Bank of Canada and Bank of Tokyo.

Bob Gagnon – P. Geo, Director

Over 10 years of experience as a professional geologist, holding positions as Ordre des géologues du Québec, Board of Directors of the Quebec Mineral Exploration Association, President of the Association des prospecteurs du Nord du Québec (circa 2012).

Why Investors Should Consider Adding Shares of Bonterra Resources, Inc.

(TSX.V: BTR); (OTCQX: BONXF)

Bonterra Resources, Inc. (TSX.V: BTR); (OTCQX: BONXF) is currently trading for a total market cap that represents just a fraction of the value of the Company’s resources at the Gladiator Gold Project.

With such a significant, high-grade gold deposit – in a prolific mining region – the value of the resources in the ground offers high upside potential for investors.

The Company is also well-financed and debt-free…has attracted the attention of some of the world’s smartest investors…and has brought on $60 million worth of investment within the past 12 months.

This opportunity for investors – to grab what appears to be a significantly undervalued gold exploration company – comes at a time when gold prices could soon move sharply higher.

But as the market takes note of Bonterra’s undervalued asset base, the window of opportunity could close quickly. Investors would do well to begin their due diligence right away and consider adding shares of Bonterra Resources, Inc. (TSX.V: BTR); (OTCQX: BONXF) before the share price begins to move.

[2] https://www.bloomberg.com/news/articles/2018-04-02/gold-to-top-1-400-as-sprott-s-rule-sees-winnerless-trade-war [3] https://www.pinnacledigest.com/mining-stocks/canada-gold-top-discoveries/