Will Acquisition, Exploration, and Production/Development of Oil & Natural Gas Properties Provide a Steady Rate of Return in a Growing Economy?

(Symbol: VKIN)

Viking Investment Group – Targeting Under-Valued Businesses with Realistic Appreciation Potential and a Defined Exit Strategy

The Energy Industry Presents a Highly Attractive Opportunity for Investors

According to the CEO of Saudi Arabia’s giant state-held oil company, global demand for oil and gas will still grow in the coming decades, so if capital investment drops, it could create “spikes” in prices and hurt the global economy, CNBC reports. Demand is still healthy and oil “will be with us for decades”, CNBC quoted Nasser as telling a Wall Street Journal panel at the Davos forum.

Crude oil is one of the most demanded commodities with the International Monetary Fund projecting global growth in oil demand of 3.5% in 2015 and 3.7% in 2016. The demand for crude oil is dependent on global, economic and geopolitical conditions as well as market speculation.

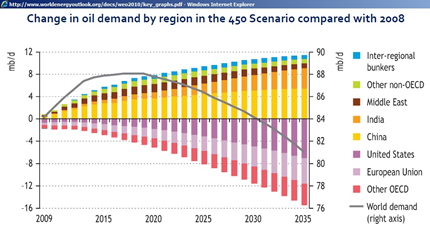

For much of the past decade, oil prices have been high because of soaring oil consumption in countries like China and conflicts in key oil nations in the Middle East. Oil production in conventional fields could not keep up with demand, causing prices to spike.

As oil prices increased, many energy companies found it profitable to extract oil from difficult-to-drill places. In the United States, for example, companies began using techniques like fracking and horizontal drilling to extract oil from shale formations in North Dakota and Texas. In Canada, companies were heating Alberta’s oil sands with steam to extract usable crude oil. This led to a boom in “unconventional” oil production.

Over the past year demand for oil in places such as Europe, Asia and the U.S. tapered off, thanks to weakening economies and new efficiency measures. Unused oil was simply being stockpiled for future utilization. As a result, in the fall of 2014 prices started falling sharply, thus creating unique acquisition and investment opportunities as a result of certain companies needing to restructure (i.e. sell assets) and adjust to new economic models.

Viking is properly positioned to capitalize on such opportunities.

Viking (Symbol: VKIN) has solidified relationships with industry experts and formulated a responsible acquisition strategy, with emphasis on acquiring under-valued, producing properties from distressed vendors or those deemed as non-core assets by larger sector participants

Viking (Symbol: VKIN) has solidified relationships with industry experts and formulated a responsible acquisition strategy, with emphasis on acquiring under-valued, producing properties from distressed vendors or those deemed as non-core assets by larger sector participants

Viking targets properties with current production and untapped reserves for future upside.

Viking Investments Group

provides professional advisory and consulting services to companies undergoing or anticipating periods of rapid growth, significant change or ownership transition, and when justified, staffing, financing, and/or providing operational support to such companies.

Viking’s primary focus is directed toward North America, targeting various industries,mainly in the Oil & Gas sector and other selective sectors, with appropriate diversification and balance between each.

Viking recently engaged Kansas Resource Development Company (“KRDC“) to operate certain of its oil and gas-related leases in Eastern Kansas.

KRDC’s subsidiary, S & B Operating, LLC, became the operator of record for the leases known as A. Wilson (East), L. Wilson (West) and Elam/Hahn in which Viking’s working interest, through its subsidiary, Mid-Con Petroleum, LLC, is 100%, 92% and 58%, respectively.

Viking owns a working interest (80 to 87%) in four leases with access to the mineral rights (oil and gas) concerning approximately 281 acres of property in Miami and Franklin Counties in Eastern Kansas, including an undivided interest in all oil and gas wells, equipment, fixtures and other personal property located upon the leased properties and used in connection with oil and gas operations. Viking’s working interests in the leases range from 15% to 84%. This project produces oil from the Cherokee formation at a depth of approximately 600 feet. These leases offer the potential for several future drilling locations.

Viking also owns a 100% working interest in three oil and gas leases concerning approximately 270 acres of property in Miami and Franklin Counties in Eastern Kansas for future development purposes

These are known HEAVY OIL AREAS.

Viking owns a 100% working interest in Missouri well with 31 leases of access to the mineral rights (oil and gas) concerning approximately 5,500 acres of property in Cass and Bates Counties in Missouri. These leases are within a prolific oil and gas region and offer the potential for hundreds of future drilling locations.

Viking Enters Joint Venture with Tanager Energy, Inc., a small-cap Canadian oil and gas company headquartered in Calgary, Alberta

Viking owns a 50% working interest in the project, which consists of 4 oil wells and one water injection well. Tanager Energy’s initial project incorporates the Leduc D-3 B Pinnacle Reef in Central Alberta, which is where the Joffre D-3 Oil Project is located.

Business is Booming. Will Savvy Investors Take Advantage?

Crude Oil faces many questions but most experts agree that the near-term outlook is upward.

As the demand for Crude Oil constantly changes, companies such as Viking Investments (Symbol: VKIN) may benefit from the long-term outlook. Trading at just a $12.6M market cap, it certainly is much cheaper relative to its peers.