Long Island Ice Tea (Nasdaq: LTEA) – A Refreshing Stock with a Juicy Breakout

(Nasdaq: LTEA)

LTEA – Quenching your Thirst for Breakout Stocks

Long Island Iced Tea Corp. operates in the ready-to-drink tea segment of the beverage industry. The Company has developed non-alcoholic, premium iced tea bottled beverages made with quality ingredients that are offered at an affordable price.

Long Island Iced Tea Corp sells, a premium proprietary recipe iced tea primarily on the East Coast of the United States through a network of national and regional retail chains and distributors.

Long Island Iced Tea Corp just announced their largest Partnership in Company History with Food Lion, one of the largest supermarket chains in the Southeast United States with over 1,000 locations in 10 Southeastern and Mid-Atlantic states employing more than 65,000 associates.

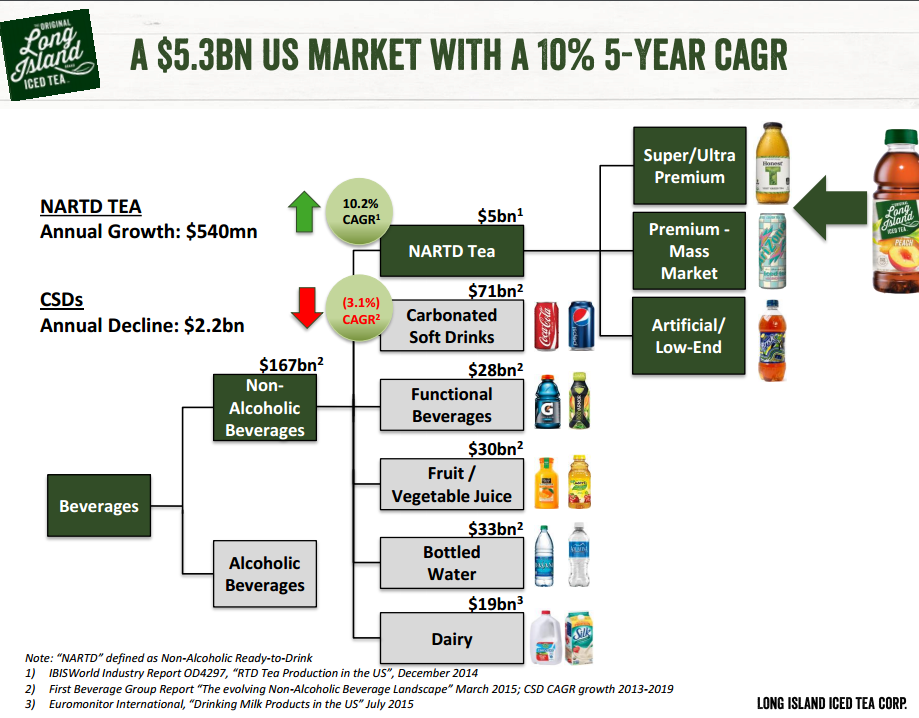

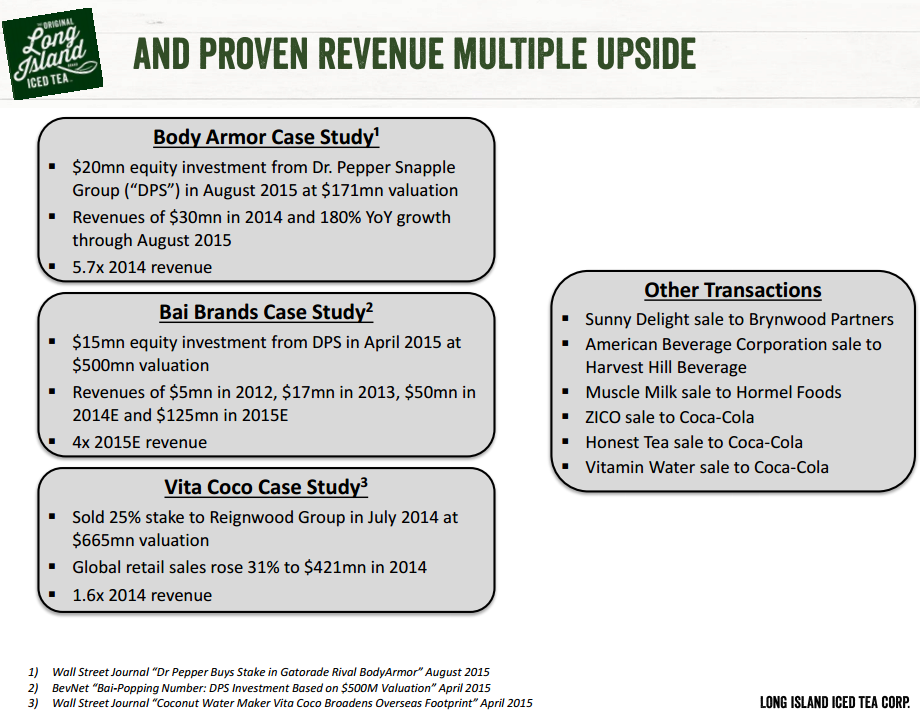

Long Island Iced Tea Corp operates in a market which is predicted to reach $1.937 Billion by 2020, progressing at a 4.30% Compounded Annual Growth Rate (CAGR).

Long Island Iced Tea Corp stands to benefit from healthy eating trends which have inspired many people to shift their preferences from alcoholic drinks to non-alcoholic beverages. The global non-alcoholic drinks market has seen a changing trend in the recent past with the introduction of organic drinks, energy drinks, and sports drinks.

Did you know?

Ice Tea is the 4th most popular cocktail beverage in the US?

Yes that is true. Ready to Drink Tea is the World’s 4th Largest Category Drink.

RTD tea and coffee have found a home in North America, their fastest growing region, due in part to increased health concerns, particularly when it comes to sweetened beverages like soda. Other driving factors for these markets include the introduction of functional beverages, rising disposable income, and increasing urbanization.

LTEA has recently expanded their distribution further in the South East United States, including Puerto Rico, increased their Northeast Distribution with a Christmas Tree Shops Partnership, and are now being sold through Krasdale Foods. This is all in the span of a few months. They have crossed the border into Canada and even the Midwest.

LTEA reported net sales of $1.6M in the 2nd Quarter of 2016 alone. Can you imagine what next quarter will bring with all these recent additions?

Now that you have an idea of just how the large stakes are here, and the incredible potential for sales growth on the corporate level, let’s take a quick look at how LTEA stock is trading

- LTEA was in a downtrend for several months. Now there is a major change in momentum as stock has become very bullish and shattered that Trend. The new trend is

- LTEA is trading right at previous Horizontal Resistance. Once the stock breaks $6.00, the 200 day MA would be a technician’s next target. Currently that sits at $7.73

- LTEA RSI shows that the stock is geared up and ready to go with minimal resistance and plenty of potential upside.

- LTEA looks to be in a great position right now and recent growth, Press, and Fundamentals could be pointing toward strong upside. This may present a great opportunity for investors to capitalize on this compelling company.

- Get started on your research now.