Overlooked Tech Boom Creates High Upside Investment Opportunity

At this moment, the majority of investors are missing out on a potentially historic tech boom.

An explosion in growth is happening in Latin America as the tech market continues to soar.

According to industry expert Counterpoint Research, the Latin American smartphone market grew 5% year-over-year in 2017 – continuing a strong growth trend.

And according to Bloomberg, Chinese venture capitalists pushed $1 billion into South American projects during 2017 – up from just $30 million in 2015 – in a sure sign that a tech boom is imminent.

Individual investors right now have a unique opportunity to take advantage of this “overlooked” tech boom by investing in companies poised to expand their presence in Latin America as this scenario unfolds.

One such company – that appears well-positioned to capitalize on this growth – is Cool Holdings, Inc. (Nasdaq: AWSM).

Cool Holdings, Inc. is a provider of wireless handsets, tablets, and related products to carriers, distributors, and retailers primarily in Latin America.

The company is one of a limited number of partners under the Apple Premium Reseller and Apple Authorized Reseller Mono-Brand programs in Latin America and the United States.

Cool Holdings, Inc. Aims to Become the Largest Authorized Apple Reseller in the Americas

Here’s what makes Cool Holdings, Inc. (Nasdaq: AWSM) such a unique opportunity for investors:

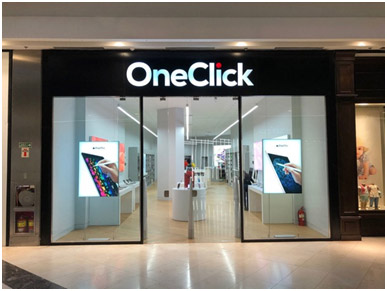

The company is focused on its strategy as an Apple-licensed partner to grow its retail footprint under its OneClick brand stores.

OneClick is one of Apple’s exclusive approved chains of boutique stores. OneClick boutique stores range in size from 750 to 2500 square feet and provide customers with the full look, feel, product line and experience of the larger, corporate-owned Apple Stores.

Cool Holdings’ OneClick stores offer not only the latest Apple products and approved accessories, but they also offer hardware and software technical service centers where customers can take their Apple equipment for repair and maintenance.

Just recently, Cool Holdings, Inc. (Nasdaq: AWSM) announced the opening of its newest OneClick store located in the El Solar Shopping district in Buenos Aires, Argentina.

This represents OneClick’s sixth store in the country, and the Company plans to open seven more new stores in the coming year in different cities across Argentina.

Apple’s Expansion in the Latin American Market Could Trigger Opportunity for

Cool Holdings, Inc. (Nasdaq: AWSM)

The rapidly-growing smartphone market in Latin America – combined with Apple’s expansion in the region – could trigger a significant growth opportunity for Cool Holdings, Inc. (Nasdaq: AWSM) over the next 12 months.

“Apple is preparing an aggressive expansion into Latin America”

Apple’s continued growth in Latin America is critically important…but it’s also worth considering that Apple’s expansion opportunities are limited.

The growth of Apple brick-and-mortar stores is limited, as Apple is not a company primarily focused on its retail store businesses.

Instead, Apple can continue its growth in newer, rapidly-growing markets – like Latin America – by working with companies like Cool Holdings, Inc. (Nasdaq: AWSM) via its Apple Premium Reseller and Apple Authorized Reseller Mono-Brand programs.

And those retail stores can be among the most lucrative of their kind in the world.

Apple Factory Stores make more money per square foot than retailers across a wide range of industries…

And while OneClick Stores aren’t quite as lucrative per-square-foot as Apple stores – they are a close second…and far ahead of many other retailers.

CoolTech Merger Brings Added Retail and Distribution Growth Potential

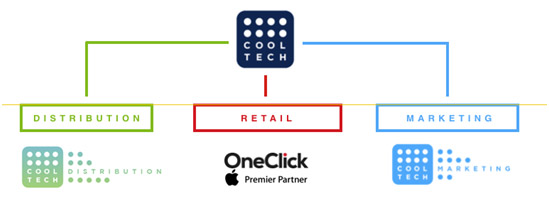

In March 2018, Cool Holdings and CoolTech announced the successful completion of the merger of the companies. CoolTech is now a wholly-owned subsidiary of Cool Holdings.

CoolTech’s business model is one of a value-add consolidation – targeting like-minded consumer technology brands – and focusing on three pillars: (1) Distribution, (2) Retail, and (3) Marketing.

No other company of this kind is doing what Cool Holdings – via CoolTech – is doing in this way:

By having distribution, retail and marketing all under one umbrella – and operating as standalone units that could survive on their own – the company offers high upside potential.

A distributor – operating independently – in the retail tech space will work extremely hard for an EBIDTA (Earnings Before Interest, Taxes, Depreciation & Amortization) of roughly 2%.

A retailer – operating independently – in this space would have similar challenges to a distributor…and would potentially bring home earnings of 5% to 6%.

And a marketing agency – working independently in the retail tech space – would consistently yield earnings of perhaps 2%.

But the model being used by CoolTech – a subsidiary of Cool Holdings, Inc. (Nasdaq: AWSM) – brings all of these units together as part of the same highly-functioning organization…

And this allows for combined yields of 8% to 9% — in an industry that typically yields just 5%.

Cool Holdings, Inc. (Nasdaq: AWSM) is planning to bring this superior business model to all of Latin America as the company works to become the largest retailer – in terms of store presence – for Apple products in the Americas.

In addition, Cool Holdings, Inc. plans to extend the reach of its distribution business by leveraging its relationships with suppliers of other recognizable brands of accessories and audio, consumer electronics and computing devices.

Those relationships include brands like…

Backed by Some of the World’s Most Successful Investors in the Retail Space

Cool Holdings, Inc. (Nasdaq: AWSM) is further buoyed by the strategic investment of two groups that have had virtually unmatched success in the retail space: The Delavaco Group and Serruya Private Equity.

The Delavaco Group is a private equity firm run by Toronto oil and mining financier Andrew DeFrancesco, and Michael Serruya, the Toronto creator of the Yogen Fruz World-Wide Inc. chain who later co-founded Canadian ice cream giant Cool Brands Inc.

Collectively, the Delavaco Group has funded, jointly funded or arranged funding in excess of C$2.2 billion over the past three years.

Delavaco and Serruya have a proven history of delivering success, making a fortune with Yogen Fruz as well as the sale of Kahala Brands – an under-the-radar franchisor of faded food-service brands, including Cold Stone Creamery and Blimpie, for around $320 million in cash and stocks – delivering a 9x return over a 3-year period.

Mr. De Francesco and Mr. Serruya were two key investors behind the revival of the Jamba Juice chain in the United States, helping the brand restructure its debt and return to profitability. They are using a similar strategy with American Apparel.

And now these two visionary investors are putting their capital – and their years of retail success – behind Cool Holdings, Inc. (Nasdaq: AWSM) and the Apple boutique store model.

Cool Holdings, Inc. (Nasdaq: AWSM) Plans for Aggressive Growth Throughout the Americas

Led by an experienced, visionary management team, Cool Holdings, Inc. (Nasdaq: AWSM) is launching an aggressive growth plan that calls for a total of 200 retail locations by 2020.

The company plans to achieve this growth via a combination of acquisition – with targets in the United States and Latin America – plus organic growth in Canada, the U.S. and Latin America.

The industry-leading experts guiding Cool Holdings, Inc. (Nasdaq: AWSM) include:

Mauricio Diaz – President and CEO

Mr. Diaz has served as the Chief Executive Officer of Cooltech Holding since December 2016. Since September 2016, Mr. Diaz has also served as the President of OneClick, and since September 2014 he has served as the Chief Operating Officer/Managing Partner of Icon Networks LLC. From August 2006 until July 2014, Mr. Diaz served as the Director of Global Business Development of Electro Group, and from July 2005 until August 2006 he served as a Senior Manager of Samsung. From October 1996 until July 2005 Mr. Diaz served as a Business Development Manager of Panasonic.

Alfredo Carrasco – VP, CFO and Corporate Secretary

Mr. Carrasco has 20+ years of career in Finance, General Management and Operations in a Fortune 500 technology industry leader. Experience leading teams in international markets streamlining operations and implementing financial controls, processes and productivity improvements. Tech Data Corporation: Vice President of Finance, Latin-America for over eight years. Multi country role creating, controlling and restructuring companies in the region. Built and developed a robust internal controls environment with a high performance team in several countries. Tech Data Mexico: Managing Director. Started up and development of the business unit from greenfield. Created a profitable entity with double digits revenue growth and streamlined SG&A. Served in other regional and in country positions for Tech Data Corporation.

Felipe Rezk – Chief Sales and Marketing Officer

Mr. Rezk has served as the Executive Vice President of Sales and Marketing of Cooltech since December 2016. Since May 2013 he has also served as the Chief Executive Officer and is the founder of Icon Networks LLC. From January 2011 until May 2013 Mr. Rezk was the Head of Enterprise Sales for Latin America at Apple Inc., and from March 2009 until January 2011 he was the Senior Manager, GTM Business Development, Emerging Channels Team at Cisco System (“Cisco”). From August 2005 until March 2009, Mr. Rezk was the Senior Marketing Manager, Emerging Markets Channels at Cisco. Mr. Rezk received his bachelor’s degree in Economics from University of Los Andes, Bogotá and a Master in Business Administration and Master of Computer Information Systems from the University of Miami.

[2] https://www.technologyreview.com/the-download/610417/chinese-cash-says-that-a-south-american-tech-boom-is-incoming/

[3] https://appleinsider.com/articles/16/01/05/apple-on-verge-of-major-retail-push-into-latin-america-first-stores-to-open-in-mexico-city