Green Energy Revolution Triggers Massive Upside Opportunity for Investors

Urgent: This Lithium/Cobalt “Double-Play” Risk Reduced Scenario Offers the Best Chance for Maximum Profits from this Historic Shift in the Energy Markets

A green energy revolution is taking place right now.

Surging demand for electric vehicles is a massive, unstoppable megatrend…a “market disruption” unlike anything seen in our lifetimes.

Just about every major car maker is planning to launch an all-electric car by 2020.

“Lithium, the so-called “white petroleum”, drives much of the modern world”

“Cobalt prices soar as investors see demand for lithium-ion batteries”

“Fears about cobalt’s scarcity are behind the metal’s recent price surge. Cobalt is hard to get a hold of, and the market [currently] remains relatively small.”

Projections call for up to 30% of all new vehicles sold by 2030 to be electric cars…a shift in consumer demand that requires major changes to the industry.

This long-term shift in consumer demand has triggered an immediate profit opportunity for those investors who get ahead of this trend.

The best way to play the green energy revolution could very well be a little-known junior exploration company that carries remarkable upside potential thanks to a lithium/cobalt “double-play” risk reduced scenario.

This “double-play” risk reduced scenario provides investors with exposure to two soaring markets: lithium AND cobalt exploration.

LiCo Energy Metals (TSXV: LIC) (OTCQB: WCTXF) is a Canadian exploration company focused on high-upside lithium and cobalt projects…and it is – right now – perfectly positioned to take maximum advantage of soaring demand for both lithium and cobalt.

A “World Class” Property Just a Stone’s Throw Away from Where 37% of the World’s Lithium is Produced

The price of lithium is up over 400% in the last three months.

With two potential high-upside properties in mining friendly Nevada – home to the United States’ most lucrative lithium properties and home to Tesla’s lithium-ion battery gigafactory – LiCo Energy Metals (TSXV: LIC) (OTCQB: WCTXF) already offered strong exposure to soaring lithium prices.

But earlier this year, LiCo Energy Metals signed a letter of intent to acquire interest in a major exploitation project in the Salar de Atacama in Chile. This is a serious game changer.

Here’s why:

LiCo’s Purickuta project is located in the Salar de Atacama. This salar is home to the world’s highest lithium grades and is where 37% of the world’s lithium is produced.

Yes…you read that correctly — more than 1/3 of the world’s lithium comes from this salar. And these large-scale, producing operations are as close as 22 kilometers (km) away from LiCo’s project.

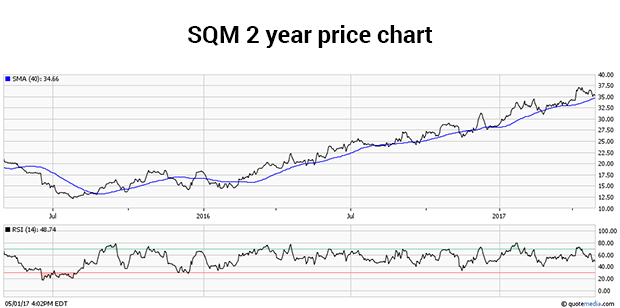

The property is literally surrounded by Sociedad Qiumica y Minera (SQM)…

This is the same SQM that is a $2.4 billion behemoth of a company and currently the world’s largest lithium producer. This is a look at SQM…

LiCo’s Salar de Atacma Purickuta project offers:

- The opportunity to move to production in the short-term

- Low cost exploration and extraction potential, thanks to lithium brines within 140 feet from the surface

- The project is close to power, skilled labour, communications, water, transportation and other important infrastructure.

- It is located within the highest-grade lithium salar in the world

- SQM operations are already happening and are just 22 km away from LiCo’s project.

- Attractive buyout potential…with two large producing companies next door.

That last point is big one – a potential acquisition is a true game-changer for investors. And with LiCo Energy Metals (TSXV: LIC) (OTCQB: WCTXF) possessing a property so close to not one but to TWO major producers…the potential for acquisition is always in play.

But LiCo Energy Metals’ lithium story is just one-half of this company’s “Double-Play” risk reduced scenario…

Exposure to the “One of the Highest-Grade Cobalt Projects in the World”

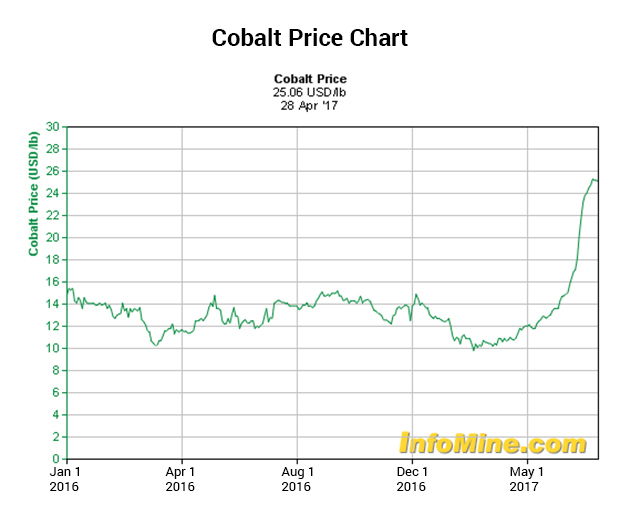

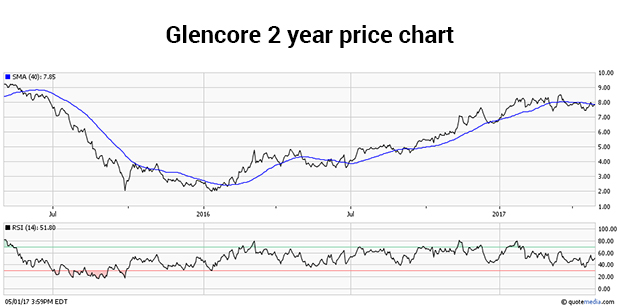

In the last six months, cobalt prices have more than doubled.

The simple fact of the matter is that mass production of lithium-ion batteries will require more and more cobalt in both the short- and long-term.

This surge in demand will easily outweigh the supply of cobalt available, and if this happens additional sources of this rare element will need be brought online quickly.

That’s where exploration companies like LiCo Energy Metals (TSXV: LIC) (OTCQB:WCTXF) can turn into potential game-changers.

LiCo Energy Metals (TSXV: LIC) (OTCQB:WCTXF) right now has a high-grade, advanced-stage cobalt project – the Teledyne Cobalt project – located in Ontario, Canada.

And with good reason.

And – just like with LiCo’s Salar de Atacma Purickuta lithium project – location is a major factor in the attractiveness of this project.

That’s because LiCo Energy Metals’ Teledyne Cobalt project is located on a property that has a $25 million (inflation adjusted) mining infrastructure thanks to its previous owners.

Situated within a historic mining camp – with valuable infrastructure in place – this could be a property that moves quickly into production…and phase one of the company’s cobalt exploration program is already underway.

Keep in mind that an estimated 18 million kilograms (kg) of silver and 14 million kg of cobalt has already been produced at this property.

But there’s even more to this remarkable property: Based on underground drilling results, inferred reserves accessible on the Teledyne property are estimated to be in excess of a 90,700 tonnes at 0.45% cobalt.

That grade makes Teledyne one of highest-grade cobalt projects in the world.

Some of the World’s Smartest Investors Are Backing this New Energy Revolution…Now You Can Join Them

At this moment, money is pouring into this green energy revolution.

Investors all over the globe are looking to cash in on the explosion in demand for renewable energy.

Some of the world’s most famous investors are rushing to stake their claim, including…

Warren Buffett

Warren Buffett Bill Gates

Bill Gates Mark Zuckerberg

Mark Zuckerberg Jeff Bezos

Jeff Bezos Richard Branson

Richard Branson

Warren Buffett’s company is investing in new solar and wind energy projects – including the world’s largest solar plant.

Even Saudi Arabia is set to invest $2 trillion into a green energy super fund.

As you can see…not only is there a massive amount of money pouring into this green energy revolution, there’s also tremendous upside here for investors who know where to look.

But tapping into this opportunity for potentially life-altering gains isn’t as simple as just investing in a renewable energy ETF or a “green” mutual fund.

Instead, investors may need to look for exploration companies with maximum upside potential. Just take a look at the last year for LiCo Energy Metals.

Right now, LiCo Energy Metals (TSXV: LIC) (OTCQB: WCTXF) offers just such potential – thanks to its unique “Double Play” risk reduced scenario, allowing investors to tap into the soaring demand for both lithium AND cobalt, and world-class exploration projects in both Chile and Ontario.

8 Reasons Investors Should Consider Lico Energy Metals (TSXV: LIC) (OTCQB:WCTXF) Today

- 1.

Surging demand for electric vehicles has resulted in massive demand for lithium and cobalt…and an explosion in prices for both.

- 2.

LiCo Energy Metals’ Salar de Atacama Purickuta project is located smack in the middle of the highest-grade lithium deposit in the world – and just 22 km from a major production operation.

- 3.

Proximity to TWO major lithium producers makes the company an attractive buyout target…which could provide extraordinary upside to early investors.

- 4.

LiCo Energy Metals (TSXV: LIC) (OTCQB:WCTXF) offers investors a true “Double-Play” risk reduction scenario, with targets for two highly sought after green energy metals: lithium AND cobalt.

- 5.

Cobalt prices have more than doubled in the last six months and projections call for prices to continue soaring higher.

- 6.

The company owns an option on a cobalt project that is one of the highest-grade cobalt projects in the world…and takes advantage of $25 million (inflation adjusted) worth of infrastructure provided by the previous owner – making this a potential “fast-track” production scenario.

- 7.

Some of the world’s most famous – and most successful – investors are right now making major investments in the renewable energy sector…LiCo Energy Metals (TSXV: LIC) (OTCQB:WCTXF) offers investors the chance to tap into this “green energy revolution”.

- 8.

LiCo Energy Metals has a growing portfolio of encouraging projects, all with aims of developing battery-grade lithium or cobalt. The company is fully funded with a strong management team that is poised to move these projects ahead.

Still hungry for more? LiCo Energy Metals can be found at: https://licoenergymetals.com